FIVE MINUTE DAILY

The year is ending with three pressure points that reach straight into everyday life. In the U.S., a familiar fight over health care costs is returning as lawmakers run out of runway. Overseas, China is signaling it is ready to spend more aggressively to keep growth on track, a move global markets are watching closely.

Meanwhile, severe weather is amplifying an already dire humanitarian situation in Gaza. Together, they show how policy decisions and natural forces are colliding as governments head into the new year.

Forward this to a friend who wants the world in five minutes.

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

The Big Read

Senate Lets ACA Subsidies Expire

The Senate rejected dueling proposals that would have kept enhanced Affordable Care Act premium tax credits in place, leaving the subsidies set to lapse at year’s end and exposing many marketplace enrollees to higher 2026 premiums. The failed votes on premium tax credits underscored how little room remains for a late bipartisan deal.

The credits were expanded during the pandemic and have helped lower monthly payments for many households buying coverage on the marketplaces. Democrats pushed a multi-year extension, while Republicans offered an alternative approach that did not attract enough crossover support.

Why it matters now: Insurers and state regulators are already setting 2026 rates, and a lapse could translate quickly into higher monthly bills and coverage churn for millions.

China Signals Heavier Fiscal Support for 2026

China’s leadership pledged to keep a “proactive” fiscal stance in 2026, leaning more on public spending and measures aimed at lifting consumption. Officials at the annual conference outlined a stimulus roadmap meant to steady growth near current targets as weak domestic demand continues to weigh on the economy.

The messaging points to larger budget deficits and increased debt issuance, alongside potential monetary steps such as interest-rate cuts or lower reserve requirements. The push reflects the tension between export strength and a consumer sector that has not taken the lead in growth.

Why it matters now: markets are watching whether policy support shifts from production-heavy levers toward household demand, and how much debt Beijing is willing to deploy to defend growth.

Winter Storm Floods Gaza Tent Camps

Heavy rain and plunging temperatures are flooding tent camps across Gaza, worsening living conditions for displaced families and complicating aid delivery. Storm impacts described in flooded camps include soaked bedding, damaged shelters, and heightened health risks in crowded sites with limited drainage and sanitation.

Aid groups are warning that emergency supplies are still not reaching people at the scale required, with displacement sites especially vulnerable to standing water and exposure. A separate warning on blocked supplies highlighted the growing gap between needs and winterization capacity.

Why it matters now: Extreme weather can rapidly turn an ongoing humanitarian crisis into an acute emergency, especially where shelter materials, safe water, and medical access are already constrained.

World View

China and the Philippines Clash Over Scarborough Shoal

Beijing said its military drove away a Philippine aircraft above the disputed Scarborough Shoal, adding to a pattern of confrontations in the South China Sea. The latest airspace incident is likely to fuel renewed calls for de-escalation mechanisms as patrol activity intensifies.

U.S. Signals Conditional Return to Ukraine Talks

The White House said a U.S. representative will join weekend talks in Europe if there is a real chance of an agreement, framing diplomacy as contingent on tangible progress. The latest talks posture underscores how negotiations are being shaped by pressure for outcomes and disputes over security guarantees.

Argentina Pushes Sweeping Deregulation Package

Argentina’s lower house approved a broad package of deregulation measures aimed at shrinking the state’s role in the economy and accelerating privatizations. The vote on a deregulation bill gives President Javier Milei a legislative win as inflation eases but social tensions remain high.

Need To Know

Senate Lets ACA Subsidy Extension Fail

The Senate rejected competing proposals to extend Affordable Care Act tax credits that are set to expire, leaving many people facing higher premiums starting Jan. 1. The failed vote on extending tax credits shifts attention to whether a late-year fix emerges and how insurers and states respond.

White House Targets Proxy Advisory Firms

An executive order aims to increase oversight of proxy advisory firms that influence shareholder voting, setting up a new policy fight over corporate governance. The order focused on proxy oversight could reshape how institutional investors and companies navigate contested votes.

U.K. GDP Slips Again

The U.K. economy contracted 0.1% in October, adding to signs of stagnation heading into year-end. The latest output dip increases pressure on the government’s growth agenda and keeps investors focused on the next rate decision.

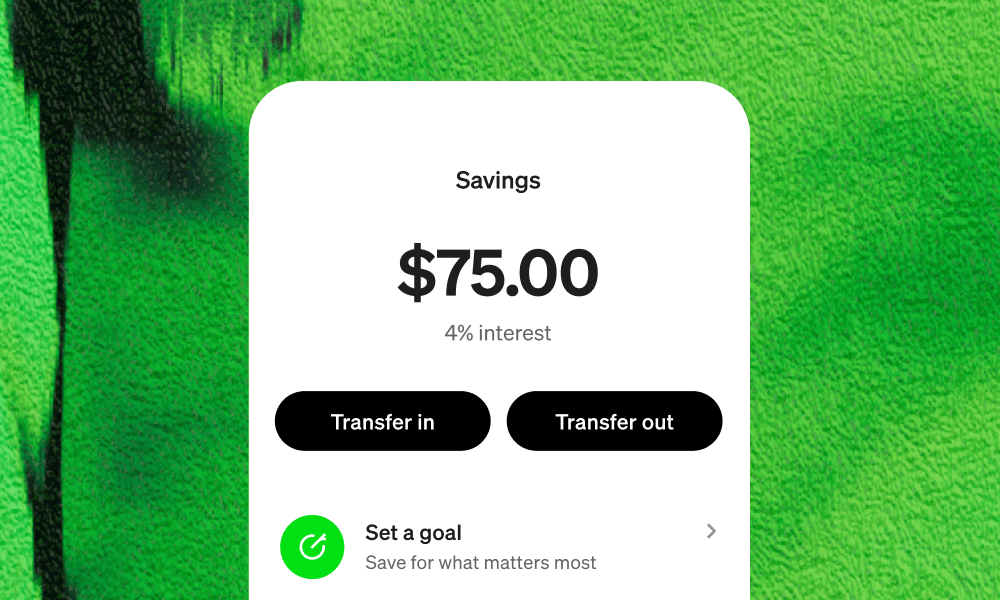

Boost Savings Fast

Customers can qualify for Cash App Green by spending $500 in Qualifying Purchases using your Cash App Card or Cash App Pay per month, or by depositing $300 of Qualifying Deposits per month. Eligibility restrictions apply to some benefits. See Terms and Conditions for more information.

To earn the highest interest rate on your Cash App savings balance, you need to (a) have a Cash App Card, or sponsor one or more sponsored accounts, and qualify for Cash App Green or (b) have a sponsored account with sponsor approval. Customers can qualify for Cash App Green by spending $500 in Qualifying Purchases using your Cash App Card or Cash App Pay per month, or by depositing $300 in Qualifying Deposits per month. See terms and conditions for more information on how to qualify.

If you are signed up to earn interest, Cash App will pass through a portion of the interest paid on your savings balance held in an account for the benefit of Cash App customers at Wells Fargo Bank, N.A., Member FDIC. Exceptions may apply. Savings yield rate is subject to change.

Start saving today

*Cash App is a financial services platform, not a bank. Banking services provided by Cash App’s bank partner(s). Prepaid debit cards issued by Sutton Bank, Member FDIC. See Terms & Conditions. Eligibility restrictions apply to some benefits. See Terms and Conditions for more information.

Money & Markets

New York Fed Details Liquidity Operations

The New York Fed outlined more than $54 billion in operations from mid-December into January, including reinvestments and reserve management purchases. The updated purchase schedule highlights efforts to keep short-term funding markets stable.

Five Things Markets Are Watching Next

Global investors are tracking central bank decisions, delayed U.S. data releases, and Europe’s debate over Ukraine financing tied to frozen Russian assets. A rundown of next week’s themes points to policy volatility as the main driver into year-end.

European Shares Set for Third Weekly Gain

European stocks were poised for a third consecutive weekly advance as optimism over potential U.S. Federal Reserve interest rate cuts boosted sentiment, with banks and cyclical sectors leading gains. The pan-European STOXX 600 index climbed on expectations that looser monetary policy may support credit conditions and economic growth into 2026.

Future Frontiers

FDA Clears First At-Home Brain Stimulation Device for Depression

Regulators cleared a home-use brain stimulation device for adults with moderate to severe major depressive disorder, expanding non-drug treatment options under remote supervision. The new at-home device could reshape access and reimbursement debates for neuromodulation therapies.

New Study Explores TRPV1-Based Intracellular Delivery

A newly published paper describes a strategy that uses TRPV1 to enable intracellular delivery of membrane-impermeable compounds, a technique that could influence how certain therapeutics are designed. The peer-reviewed TRPV1 approach adds to a growing toolkit for targeted delivery.

A New Oral Antibiotic Shows Promise Against Gonorrhea

A study reported that a single-dose oral antibiotic from a new class performed as well as the prior standard of care for uncomplicated urogenital infections. The results on zoliflodacin are being watched closely as resistance erodes existing options.

The Score

Wild End Stars’ Streak

Minnesota beat Dallas 5-2 to snap the Stars’ 11-game point streak, with Marcus Johansson scoring twice. The full game recap captured a swing night in the Central race.

Oilers Beat Red Wings Behind Hyman Hat Trick

Edmonton topped Detroit 4-1 as Zach Hyman scored three times and Connor McDavid added four assists. The Oilers win kept pressure on teams jockeying for position in the West.

Hurricanes Edge Capitals in a Shootout

Carolina beat Washington 3-2 in a matchup of top Eastern Conference teams, sealing it in a shootout. The shootout finish added another tight result to a crowded standings picture.

Life & Culture

“Street Fighter” Teases a New Live-Action Take

A teaser introduced key characters for an upcoming live-action adaptation, setting expectations for a franchise reboot. The first look in the teaser trailer is already driving early fan scrutiny.

Taylor Swift Docuseries Rolls Out Weekly

A new Taylor Swift docuseries begins weekly releases on Disney+, alongside the debut of a concert film tied to the same project. The rollout in first two episodes reflects how platforms are packaging big music releases as serialized events to extend audience engagement.

“Troll 2” Arrives With Bigger Scale

A new review frames the sequel as a polished follow-up that leans into spectacle while staying close to the original’s appeal. The latest take on “Troll 2” signals how streaming franchises are building global audiences.

Deep Dive

Europe’s Plan for Russia’s Frozen Assets is moving toward an “indefinite immobilization” of Russia’s central bank reserves held in Europe, aiming to replace six-month renewals that require unanimity with a structure that is harder to unwind. A near-term agreement on the long-term freeze is intended to keep roughly €210 billion locked down and to support a loan framework for Ukraine’s 2026–27 financing needs.

The motivation is as much political as financial. As long as sanctions must be renewed unanimously, a single government can threaten to hold up the process, raising uncertainty for Kyiv and for European planning. EU institutions are seeking a path that reduces veto leverage, with reporting describing a design that would also limit the ability of dissenting capitals to block the underlying mechanism. An EU effort to lock up assets is also meant to reassure markets that the funds will not suddenly be released in a political bargaining moment.

Legal risk is the central constraint. Russia’s central bank has called the plan illegal and said it is pursuing court action tied to Euroclear, where most of the immobilized funds sit. The latest legal pushback highlights a core question: how far Europe can go in using, pledging, or leveraging sovereign assets without formally confiscating them, while still protecting member states and intermediaries from claims if sanctions eventually change.

Banks and governments are also weighing what happens in edge-case scenarios, including a future settlement that does not clearly assign reparations, or a dispute over who bears liability for any loss. In parallel discussions, financial institutions have warned about exposure and indemnity needs around proposals that treat frozen sovereign assets as collateral. What to watch next is whether the EU can pair durability with legal safeguards that markets will accept, and how Moscow responds across courts, countersanctions, and pressure on Western assets.

Extra Bits

A Falcon 9 mission put 29 satellites on orbit in the latest Starlink launch.

Washington is moving to centralize AI policy as a new order targets a patchwork of state rules in the AI preemption push.

A corporate dispute escalated after a reported legal move described in a cease-and-desist between two major U.S. companies.

Today’s Trivia

What was the original name of New York City?

That’s the day’s essential readout, with the context you need to follow what happens next. Forward this to someone who wants a faster, clearer way to keep up.

—The Five Minute Daily Team